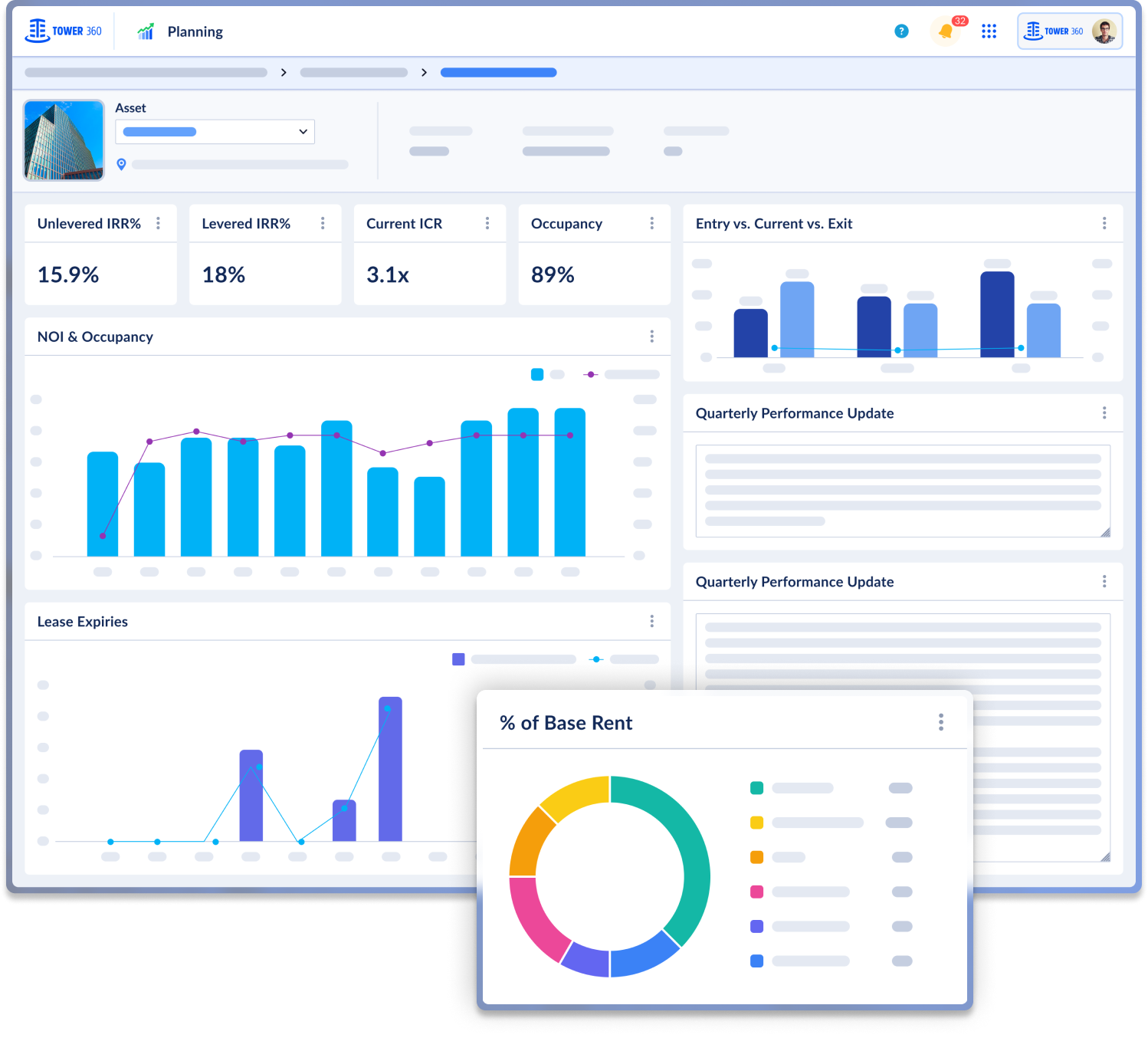

While the real estate industry is highly data driven and collaborative, it is still relying on siloed and antiquitated software, spreadsheets and manual processes. Tower360 enables real estate asset managers to eliminate manual processes, and leverage better insights through analytics, and focus on the long term relationships with their tenants.

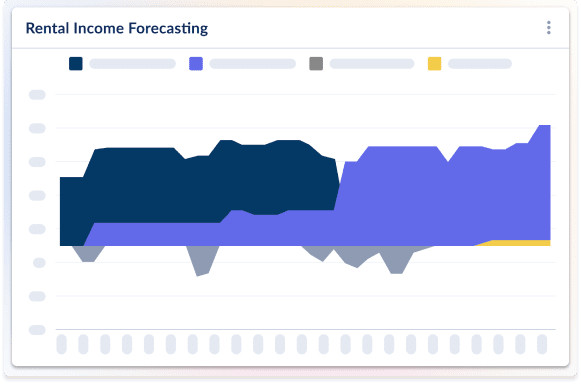

Develop detailed business plans utilizing the latest lease data and market assumptions to automate budgeting and reforecasting for all real estate assets.

Collect real-time data by connecting the chart of accounts to compare monthly budgets with actuals. This process helps measure performance, identify variances, run scenario tests, and reforecast your budgets.

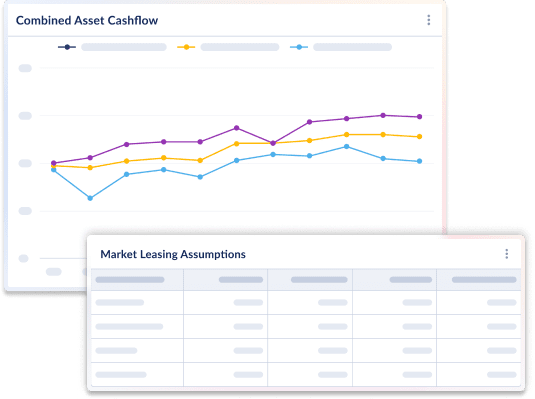

Tower360 offers powerful sensitivity tools, allowing you to see the impact of changes in your investment structure.

Conduct portfolio-level sensitivity analyses and scenario planning to assess risks and opportunities, focusing on the impacts on revenue and debt covenants.

Predict changes in market inflation or rent. Test the effects of changes in ownership, such as property acquisition or disposition. Quickly generate reports including net cash flow and the impact on the internal rate of return (IRR).

Visualize your investments structures, calculate Waterfall, distributions and promote.

Enhancing acquisition or divestment strategies with performance benchmarking and analytics.

Utilize diverse reporting tools for asset and fund levels to track manager progress and 'lock' forecasts post-approval.